Supreme Court Decision Person Taking Out Mortgage Pays AJD

Supreme Court Ruling Mortgage Borrower Pays AJD

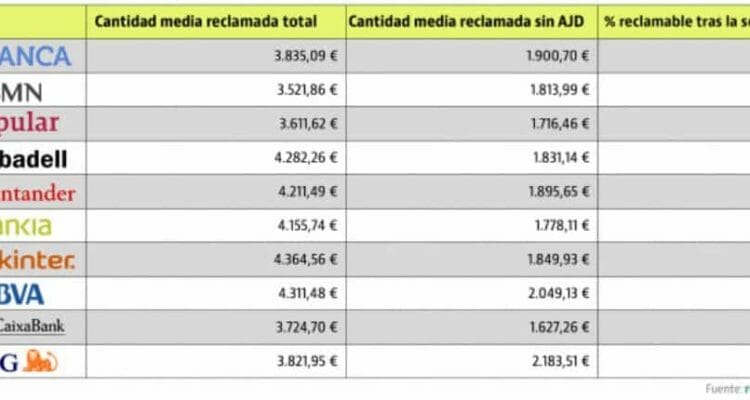

The average set-up costs for a mortgage is around 3,000€ to 4,000€ depending on the amount borrowed. This is roughly broken down into a tax on notarised documents (AJD), notary fees, administration fees, land registry fees, stamp duty and copies of the notarised document. Back in December 2015 a leading case paved the way for people with mortgages to claim back the costs that they had been forced to pay. The Court decreed that mortgage lenders do not have the right to decide these should be paid for by the other party. It stated such costs should be shared but did not go on to stipulate percentages. The implication was that it should be an even split at least.

This led to claims against mortgage lenders and the flood gates opened. The Law Courts are always busy, and the last thing needed was additional workloads. Having said which, many judges in Autonomous Communities seemed to champion the little man, striking out clauses they deemed Unfair Terms and forcing the mortgage lenders to pay back what they had charged plus legal expenses of the claimants.

All has now changed again. On February 28th 2018, the Plenary of the First Chamber of the Supreme Court deliberated and decided two appeals in favour of the mortgage lenders. The Obiter Dictum, or wider generalisation to be taken from this, is that the Transmissions Tax on Documented Legal Acts (AJD) must normally be paid by the client, while the stamp duty on the notarial documents will be paid by both parties. Costs of copies of the mortgage will be borne by the party who requests them. In Andalusia the AJD is 1.5%. this leaves notary fees, administration fees and land registry fees up for grabs.

The Court’s judgment is based on a Statutory Regulation that says the loanee is the one who pays the tax and as a result the party mortgaging their home, the mortgagor, is liable. The full court decision has yet to be published, but as it stands, without the in-depth analysis of the Court’s findings, the court has used a Regulation to serve as a magic wand to restore order and quell rebellion. But a Regulation has less legislative force than a Statute conferred by Act of Parliament and is not of universal application. It wields the equivalent force of a statutory instrument.

A Supreme Court decision ‘trumps’ that of a lower Court. But, provincial courts in Autonomous Regions have consistently ruled in favour of the mortgagor since the leading case in December 2015. Until there is legal certainty, this political duel looks likely to continue. Let’s see what the Judgment proclaims when it is published in the next few days.