Protect Yourself with those Property Bargains in Spain.

It can be nerve racking or a breeze buying a property in Spain. We are an agency in Andalusia and different autonomous regions have slightly different taxes but all require 3 main things: a foreigner’s tax number called an NIE number, Title Deeds signed before a Notary and Land Registry of the property purchase.

An NIE number is something you get from the Police Station. If you use a lawyer for your purchase they will get this for you or you can apply yourself. Here are a couple of examples of how to fill the form out and each line translated. The reason for needing an NIE must also be stated.

English instructions how to fill out NIE form

Title Deed Price and Amount Paid

There was a time when properties were sold for two different prices, coyly known as ‘A’ and ‘B’ monies. The ‘A’ price was on the Title Deeds and the ‘B’ was cash in hand counted with spit dampened fingers far from the Notary walls. Even today the Spanish tax office turns a blind eye on a 15 – 20% difference plus or minus from the normal market price. Don’t be tempted though. In general, they don’t trust you and suspect something is afoot if you get too much of a good deal or agree to a bad bargain on your part. A Buyer will end up paying tax on the amount the government thinks the property was really sold for, the imputed amount. The only way to avoid it is to get a property valuation done and take your claim to court. Costly and time consuming if you lose.

For those of you interested, the imputed amount or REAL VALUE is based on coefficients from town halls, the Title Deed Price and the Cadastral Reference – based on sometimes outdated surveys of land boundaries. By or before July 2018 a land law reform is being introduced. Current recommendations by a government commissioned think tank is to change the REAL VALUE to reflect only the Title Deed Price. Another idea being mooted is to start charging a local capital gains tax on rural properties as well as the current policy of applying it to urban properties on gains from selling your property.

As we’ve seen, sales have picked up, still not a high percentage of conveyances, although slowly improving. The years of recession from 2007 hit Spain well below the belt with repossessed properties and ghost towns of brand new housing estates. In the noughties so many people were dependent in one way or another on the construction industry. When it ground to an almost complete halt, so too did the country. Fortunately, people and things evolve; no-one wants to return to those dark days, but the unscrupulous soon left the industry – why would they stay? There were no longer any rich pickings. The agents and agencies that managed to hang on in there during the lean times came through with a limp and a smile. Many, like TMT Spain Real Estate, offer more to Buyer and Seller as a matter of course. We feel we have a duty to explain and inform, both to our clients selling and the applicant looking to buy. Clearly, both form part of the same process. Naturally, we believe we always have done and our team have transferred skills and knowledge accrued in other professions as well.

What is an Agent?

An agent is just that, an entity acting on behalf of another. When it comes to properties the relationship is a tad contrived. The Buyer is usually an interested party whilst our client is almost always the Seller – but both come together in a bargain of offer, acceptance and consideration. The process can be incredibly fast or proceed slowly and cautiously. We don’t mind, we’re there to help however long the journey. Our local knowledge and connections are relied on by Seller and Applicant alike. Whether it be by acting merely as a de facto tourist information service – every Estate Agent recognises that function, or making sure you understand how properties are bought and sold. Our neck of the woods is the autonomous region of Andalusia, Spain.

Buying & Selling Resale Properties in Andalusia.

There are many more Resale properties on the market than new builds, but you can once more see cranes along the skyline. This is happening because of unfinished promotions being revamped and also due to brand new green field sites being built – both courtesy of new Land Law Legislation for Developers and Promoters to take the plunge and invest in Spain.

If the house you want to buy has had others living there already, a Resale, termed ‘second-hand’ in Spain, you need to check the following documentation:

- Title Deeds. Make sure the person selling the property really is the owner or authorised to sell. We check this as part of our general due diligence when we list a property.

- Ownership and status of housing charges. (Simple Note of the Property Registry). For this you need to ask for ‘Datos Registrales’ which give ‘Finca, Tomo, Libro & Inscripción’ stating what the property registration number is and where it is filed – both literally and in which district. This information is on the Title Deeds or a copy of a ‘Nota Simple’

- Last annual IBI receipt (Council Tax or Urban Tax, Impuestos Bienes Inmuebles).

- Community of Owners’ receipts proving that the seller is up to date with payments of shared community expenses. (It’s a proprietor owned management company.)

- Latest receipts of utilities: water, electricity, gas, etc.

- Completion on Property. If the conveyance follows the normal convention the Seller pays the costs of cancelling his/her mortgage and the bulk of the Notary costs for drafting the new Title Deeds. The Buyer pays for the Title Deed copies, registration fees and, as appropriate, VAT or Property Transfer Tax. However, it is not mandatory to follow that convention although common.

- The Seller needs to make sure they have a certificate of the energy value which they hand to the notary before sale.

The Buyer should allow approx. 12% – 15% on top for costs. You pay Stamp Duty, Transmission Taxes, Notary Fees and Land Registry Fees. Plus, lawyer’s fees should you decide to instruct one. (It is not obligatory.) In the past, you also had to pay the mortgage lenders’ Notary and Stamp Duty costs for putting the mortgage in place – which with the admin fee added up to about 4% of the amount borrowed. But this practice has been ruled out by the Supreme Court as an unfair contract term and now you only pay an admin fee on taking out the mortgage, the valuation and any costs that fall directly to you. Those who paid this in the past can claim back these costs providing the mortgage is still in place or was paid up in the last four years. Refunds in Andalusia are on average 4,313 € according to the property portal Idealista and Legal Services Provider, Reclamador. (a ‘crowd complainer’ platform,). The protection available for the consumer does serve to underline how the legislature has acted to inject confidence in the property market once more.

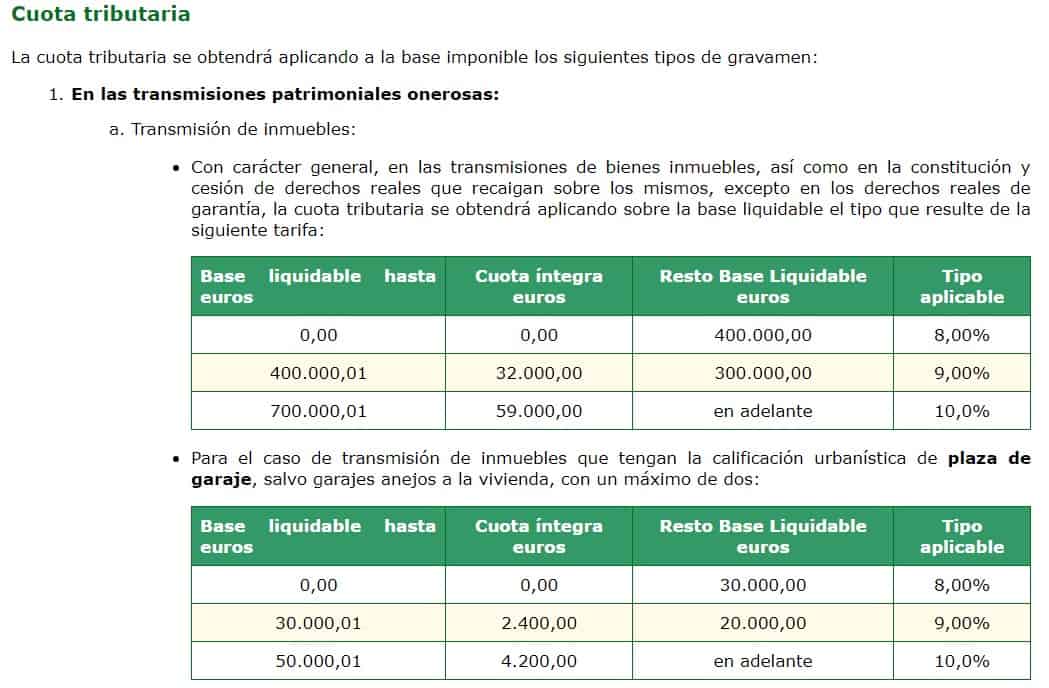

Property Taxes are levied against the price of the property as stated in the Title Deeds. At the time of writing, assuming no special cases, THE BUYER pays 8% ITP on a property up to 400,000 €, 9% from 400,001 € up to 700,000 € and 10% thereafter.

Garages and Parking Spaces in Underground Garages can either have a separate Property Title Deed or be annexed to the Residence’s Title Deed. For separate Deeds it’s 8% tax up to 30,000 €, 9% to 50,000 € and 10% thereafter for a maximum of 2 garages or parking bays. Make sure you know which parking space belongs to the house or apartment that you are buying, it’s an area that can sometimes be overlooked. The applicable Property Taxes are the same as for properties when sold in the same Deeds.

Property Sellers are responsible for:

- Certificate of Energy Rating. ‘Calificación Energética’. Drawn up by an architect evaluating the energy consumption of the dwelling. In Andalusia, almost all resale properties rate as Grade E, with Grade A being the highest, it may not be perfect, but it is normal.

- Town Hall Capital Gains Tax – Incremento del Valor de los Terrenos de Naturaleza Urbana (IVTNU), more commonly known as plusvalía municipal. The clue should be in the name – you have to make a capital gain to pay this. But many local authorities have been exacting payment form Sellers even when they sold at a loss, basing the value on the cadastral reference as well as the old inflated market prices and opting for whichever price was higher. Note, a Supreme Court decision enshrined in law 15th June 2017, has tried to make it illegal for town halls to invoice Sellers for this if they have sold their home at a loss. People who were forced in the past to pay it despite making a loss can now claim this tax back from the Town Hall. It’s an odd remedy called a revocation process (Procedimiento de revocación.) What makes it strange is how the decision to go ahead with the claim lays in the hands of the local authority. (IKR.) Court decisions are now starting to create their own precedent. And yet, we are still awaiting legislation that stops town halls from invoicing. This is the complication. They have up to 4 years to do so. This means that in practice the Seller needs to file claiming 0€ owed. But at present the town hall could challenge this in that 4 year time frame. Really not acceptable in our opinion when people have sold at a loss and it shows this on the title deeds.

Buying Off Plan or New Builds confirm the following:

- Works Licence in place

- Bank Guarantee to protect in case developer goes belly up

- Occupancy Licence issued before completion

- Building Specifications have been adhered to

- Stage Payments where appropriate coincide with actual completion of construction stage as described

- Snagging List done and signed by both parties

- Utilities supply and connection paperwork formalised

- Value Added Tax is 10%

Other than that, enjoy your home in the sun, next to a pool in summer and a wood burning stove in winter.

There’s never been a better time this decade to move home or shuffle portfolios.

And if you are looking to buy or sell a property in Southern Spain, get in touch with TMT Spain Estate Agents – we’re happy to help.

(Article updated 5th April 2019 to reflect changes in the mortgage law.)