Property Prices Rise 5.7% in 2016 – Britons Lead the Way

Property Prices rise – now is the time to buy.

- House Buying was up 13.9% in 2016 compared to 2015

- A quarterly increase of 1.9% in the IPVVR (Case & Shiller Methodology of the price of housing applied to Spain)

Property Sales

- 93,423 operations as property prices rise

- 11.2% more than in the same quarter of 2015

- The best result of a fourth quarter of the last seven years.

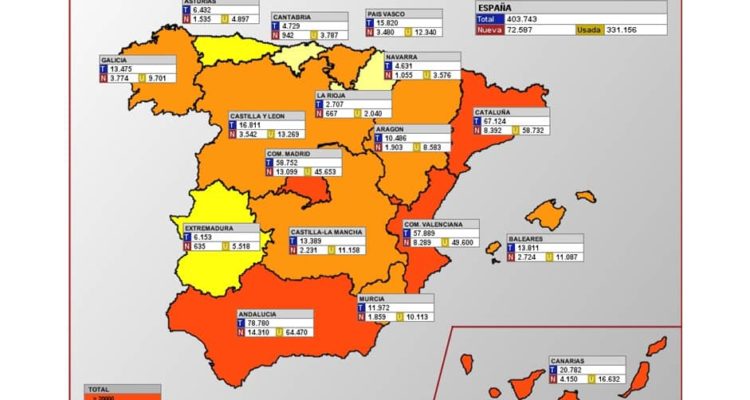

- The year 2016 has broken the 400,000 registered sales barrier with 403,743

- Best year-on-year figure since mid-2011, with an annual increase of 13.9%. However, behaviour remained distinct with resales increasing to 18.5% while new housing showed a decrease of 3.2%.

Property Purchases by Foreigners

- Ex-pats and second home owners find the bargains – unphased by BREXIT.

Brits Top New Owners Figures

The fourth quarter of the year shows the highest percentage of foreign purchases in 2016, with 13.6% of home purchases.

13.3% of purchases were made by non Spaniards, around 53,000 operations, of which the British led the way.Mortgage Patterns and Stats

- The average mortgage debt for 2016 was € 111,656, a year-on-year increase of 2%.

- Fixed interest rates were up by 31% in respect to new mortgage loans, a new historic high.

- As property prices rise there is growing availability of Mortgages

- Average mortgage loan in the fourth quarter was 524.7 euros.

1.7% lower than the previous quarter, while the percentage of salary it cost to pay the mortgage went down 0.45 percentage points to 28.3%.

- Year-on-year results marked new historic lows (over the last fourteen years), with € 522.6 million and 27.5%. With respect to 2015, it represents a decrease of 2.7% in the mortgage rate and -0.88 pp. with respect to wage cost.

It’s a great time to buy.

Note: The complete report can be accessed (in Spanish) at the following link: http://www.registradores.org/portal-estadistico-registral/estadisticas-de-propiedad/estadistica-registral-inmobiliaria/ Spanish Land Registry.